Did Wall Street Accidentally Kill Solar Energy?

Long-term financialization has eroded the incentive to back innovation.

After President Donald Trump’s new executive order in support of the coal industry, it seems incumbent upon the private sector to pick up the slack in transforming America’s energy structure. The success of the fight against climate change depends on it. But are private firms capable of fostering that kind of innovation on their own? Or have decades of short-term-profit economics irreparably hobbled their ability to do so?

According to a new report in Science Advances by Max Jerneck, which examines the circumstances which led to the diminishing of the American solar industry 40 years ago, the latter may indeed be the case.

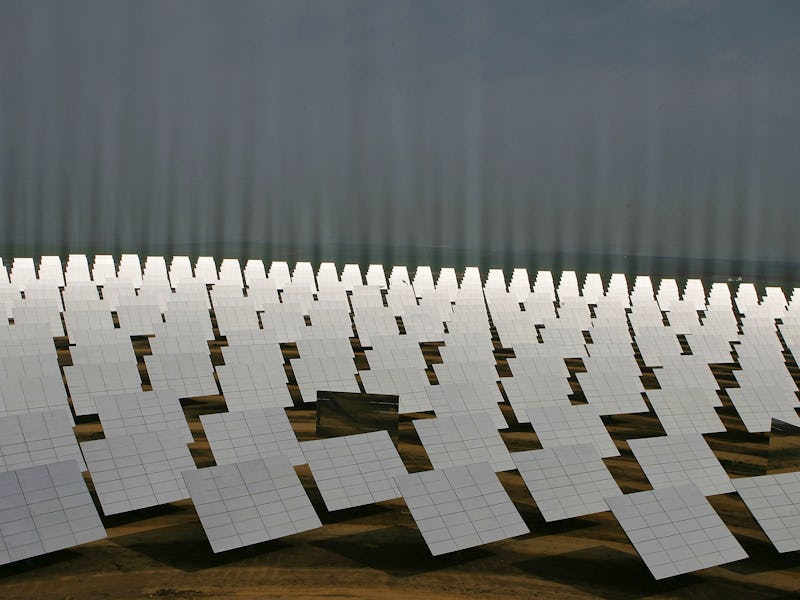

Jerneck’s report, “Financialization impedes climate change mitigation: Evidence from the early American solar industry,” contrasts the development of the American solar energy industry in the 1970s and ‘80s with the Japanese solar industry during the same period.

During that time, Japan’s share of the market was increasing in a rapid advance, while America’s was falling sharply, down from 95 percent in 1978 to 55 percent in 1984. By the time the twentieth century rolled around, the disparity between the industries was colossal. In 2005, Jerneck says, Japan controlled more than half of the global solar market. America’s share was a meager 9 percent. Still today, East Asian markets — in China and Japan — control the lion’s share of the world’s solar industry.

The cause of this? Financialization, says Jerneck. The primacy of immediate gains over possible, if uncertain, future returns. Because investing in new technologies is risky by its nature, reluctance abounds when the potential for failure is a big enough additive to the financial mix. Jerneck tells Inverse that this was bad news for innovators.

“New technologies need patient capital. They need to be developed by firms that are committed to long-term innovation, and reinvest their profits in their knowledge base instead of handing it back to shareholders.”

Absent any guiding governmental policies or similarly compelling incentives, the argument goes, companies will begin to see fewer and fewer reasons to venture out into newer markets.

Over time, “firms have become less oriented toward investing to improve their long-term performance and more oriented toward enriching their managers and investors in the short run,” writes Jerneck. “Reinforced by managerial incentives, increasing amounts of profits are spent on dividends and stock buybacks, leaving less for investment in long-term technological development.”

In the end, Jerneck claims, it was the differing structures and priorities of Japanese financial institutions, “bank financing, cross-shareholding, enterprise unions, and lifetime employment,” that enabled them to get ahead of the game.

So what does this mean for the future of solar energy, both around the world and in the United States? Have Wall Street’s practices condemned it to be infirm in America for the foreseeable future?

Jerneck says it could go either way. From a global perspective, he noted that markets in places like China are still going strong, so it’s not as though the availability of solar energy will disappear. There, he says, the “industry is poised to develop extremely rapidly, but given the emergency of climate change, no speed is rapid enough.”

As far as the United States is concerned, Jerneck says the prevailing mood is a determining market factor.

“Wall Street runs on optimism. When spirits are high, there is no stopping the money flowing.”

In that sense, it’s just like any other kind of gambling. If people are feeling confident, they’ll put more money up. But that optimism is fragile. For an innovation industry like solar energy, which depends on those good feelings to open up the checkbooks, something like a recession can chill its chances of success.

The solar industry is also not without its own competitors. Other “fossil fuel technology also continues to develop, backed by a lot of money and powerful organizations,” says Jerneck. Those organizations now include the federal government. “Few people saw the boom in fracking and shale coming. Maybe something will bring back coal again. Let’s hope not … but it is a race.”

For the sake of the planet, it’s a race that solar probably has to win.

Reporting by Dyani Sabin.