Venmo Faces Competition from Goldman Sachs on Free Instant Cash-Outs

Would you pay to get your money quicker?

Ever waited days for your Venmo balance to get to your checking account? Both the company and rival payment apps are looking to take care of that pesky annoyance. The next frontier in person-to-person payments is instant cash-outs — and one upstart app wants to make them not just instant, but free.

Payment apps know most users want their money quicker than the standard multiple business-day transfer period. But banks charge fees for quicker transfers, so apps either need to charge users a premium or eat some or all of those costs.

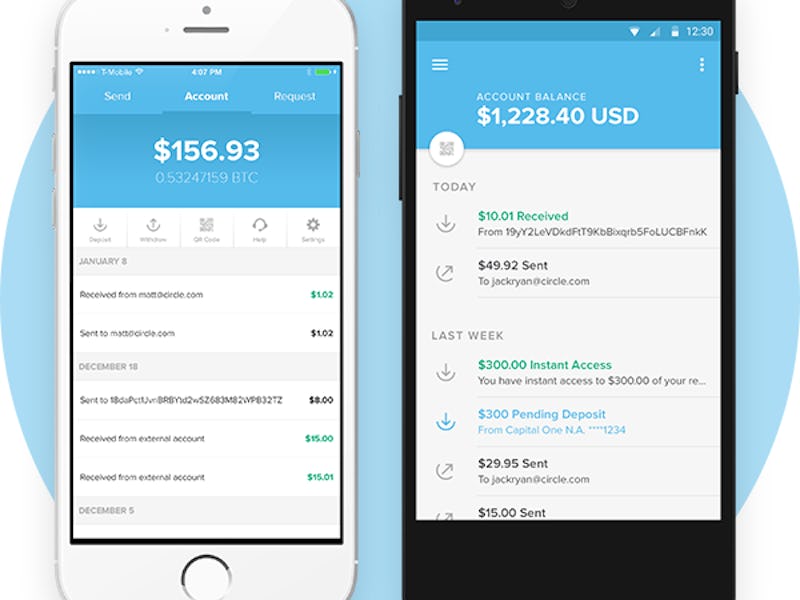

Circle Pay chooses the latter option. It offers free instant money transfers within minutes.

“Circle believes that money should work like any other kind of content online,” the company tells Inverse. “It should be instant, free and global.” This is why Circle chooses to eat the cost of instant cash out.

Other apps aren’t so generous. Square Cash, which is owned by Twitter CEO Jack Dorsey’s $12.62 billion company Square, currently charges users one percent of the deposit amount to get their cash instantly, the company confirms to Inverse.

Meanwhile, PayPal-owned Venmo will roll out a similar feature in the coming months, charging users a $0.25 fee for instant bank transfers.

“Funds will typically be available in a user’s bank account in a matter of minutes, although some banks may take up to 30 minutes,” a Venmo spokesperson tells Inverse. The platform is currently estimated to have about seven million users. Neither Square nor Circle releases user numbers, but they are both thought to have fewer than Venmo.

Square Cash offers instant payouts for a fee.

Square and Venmo’s moves toward a premium option for instant cast outs could mean that feature will help companies make a profit on payment apps. Circle, however, is going a different way by absorbing the costs — perhaps believing that, in the long run, that big perk will translate to more users than its competitors.

Circle goes beyond free payouts, offering instant cross-border and currency payments across around the world. They also offer FDIC insurance of up to $250,000 for your payments.

Circle’s basic idea is that “money should work like any other kind of content online — it should be instant, free and global.” The only way for Circle to make that possible is to absorb the transaction cost. That ethos is in line with tech giants like Facebook and Google, which both take on many of the costs associated with operating their ventures.

So while Venmo and Square hope to monetize by charging instant transfer fees, it’s apparent that Circle is looking beyond passing on the fees to users.

Circle, which has raised $140 million from investors including from Goldman Sachs, says the tech behind payments platforms “will create opportunities for new models of lending and credit and new avenues for saving and investing.”

These models include new ventures of saving and investing, built on blockchain tech and point toward an open, borderless and software-powered future for consumer finance.

Indeed, the future of digital currency seems bright at the moment (see Bitcoin), but it’s too early to tell whether platforms can rely on other means of cash flow or rush to monetize peer-to-peer pay.

With the launch of Apple Pay’s Cash beta this month, the huge player entering the digital payments space may be the decider.