Evolve or die, those are the watchwords of the digital age. Newspapermen cash their severance checks to day drink, the music industry chews ash. But one collection of Maryland libraries is making a case that brick-and-mortar book lenders still matter with a whole new way to engage the people that need them most.

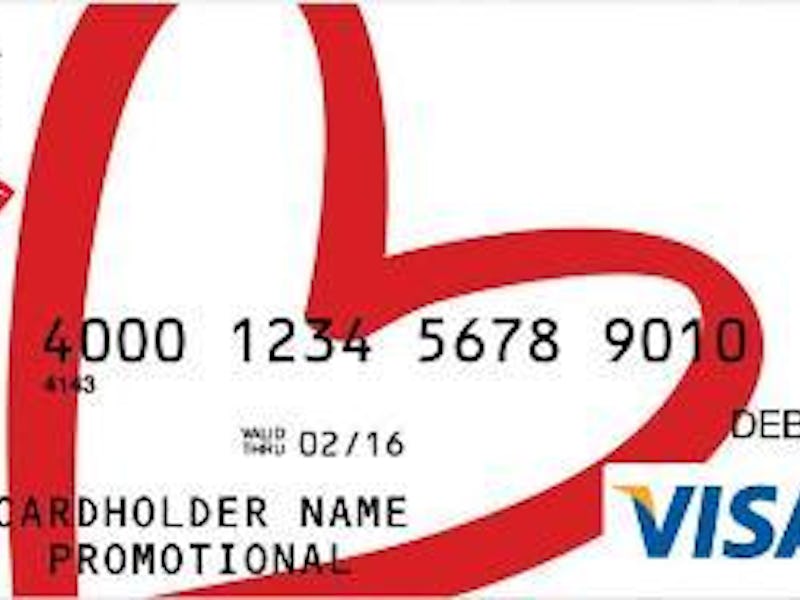

The Frederick Public Libraries is officially underway with their own brand of pre-paid Visa called the “I Love My Library” debit card. Right about here you might say, “Great, library debit cards, who cares?” Well, if you were counting the days between now and your next check wondering how the hell your last $20 was going to feed your kids and pay the $40 past due electric bill, this is the kind of news that would perk your ears up. I’ll explain.

Libraries, by the virtue of offering things like computers and books free for public use, bring in a lot of down-and-outers, many of whom are part of the 8.2 percent of Americans who don’t have any form of traditional banking. No savings accounts, no checks. For most this isn’t a choice, it’s just one more thing you might have to deal with when you’re poor and struggling or an undocumented worker. Don’t worry about the finance people on this one though, just because someone’s barely got enough to keep a roof over their heads doesn’t mean they won’t get their pound of flesh. It’s estimated that people without accounts along with the other 20 percent of Americans classified as ‘underbanked’ (checking account, but still relying on non-traditional revenue streams like payday loans) spent an estimated $89 billion in fees and interest rates through Alternative Financial Services in 2012 alone. Alternative Financial Services is a nice euphemism.

Don’t worry about the finance people on this one though. Just because someone’s barely making enough to keep a roof over their heads doesn’t mean they can’t be skinned. People without accounts along with the other 20 percent of Americans classified as ‘underbanked’ (checking account, but still relying revenue streams like payday loans) spent an estimated $89 billion in fees and interest rates through Alternative Financial Services in 2012 alone. Alternative Financial Services is a nice euphemism for pawn shops and selling your plasma for cash.

ATF’s come with huge interest rates and hidden fees and quite a few, like those plasma companies, pay out in pre-paid debit cards instead of hard cash. Typically, those cards are one more way to nickel-and-dime the desperate. Activation fees, overdraft fees, fees for non-use, fees for using the card at a non-approved ATM. Not a lot of money to most of us, I hope. A couple bucks here and there. But it adds up. And if you’re in a position where selling your plasma at $20 a pint is a good option, losing 10 percent of that just trying to access the funds stings a lot more than the needle.

Frederick Libraries recognized they had a base of patrons using these cards and developed their own. These cards are a long way from perfect — there’s still an activation fee and a monthly maintenance fee, though it’s far from the high end for cards like this.

But to their credit, the library, who worked out this set-up with Visa and SirsiDynix, made sure these cards had no overdraft features, hence no overdraft charges, no fees to wire transfer money over or to get a direct deposit, like a paycheck, and if the patron stops using the card, the monthly rates stop on their own, and if you start it up again you don’t have to pay re-activation. Not perfect, but a step in the right direction. And a good incentive to move away from debit card systems they might already be using and getting fleeced for a lot more.